Business Overview:

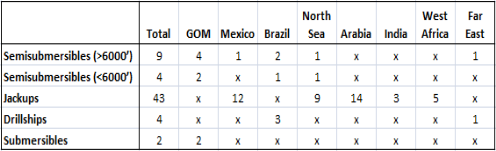

Noble Corporation is a contract oil and natural gas drilling company. Its fleet consists of 62 mobile offshore drilling units (excluding additions from the recent Frontier Drilling acquisition). Shown below is the latest status of its fleet:

Business Analysis:

Operating revenue for Noble and other contract drilling companies depends on drilling activity by exploration and production (E&P) companies which in turn depends on the outlook for oil prices. In the last three years, crude oil prices have gone through a wild ride causing drilling activity to peak and then to fall off very rapidly. The industry uses two metrics to evaluate the key drivers for revenue:

(i) Average Day Rates:

(ii) Average Utilization:

Jackups Segment:

Day rates have been coming down as drilling activity has slowed. Also, during the peak of the cycle, contract drillers around the world ordered a record number of new Jackups. These are also known in the industry as “being built on speculation”. These newbuilds are expected to flood the market starting 2010. Most of these newbuilds are uncontracted and thus are expected to put tremendous pressure on day rates for the resetting Jackup contracts for Noble Corp as well as its competitors. Shown below is the data for Jackup Market (Data from RigZone’s 2010 Jackup Market Outlook):

Jackup day rates for Noble Corp were lower in 2010 H1 than for the industry going into 2010. This trend wasn’t specific to Noble Corp, but was evident for all other competitors too – mostly because of the oversupply conditions in this market.

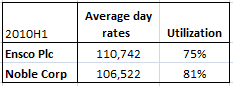

There are factors other than supply/demand that determine “day rate” for a specific rig in a contract. To name a few, factors such as age of the specific rig, high spec capabilities, the contractor’s track record, operator needs and relationships, and specific rig’s maintenance and performance records also play some role in the pricing equation. Although the average age of Noble’s fleet is 27 years old, it has “rebuilt” (made substantial improvements to) a majority of them. The average age of its Jackup fleet taking this into consideration is 13 years. Ensco has the youngest Jackup fleet (in the same sense) in the industry with an average age of 9 years. We can compare metrics for Ensco’s Jackup fleet to that of Noble to get a sense of the difference (there isn’t much):

The other factor that helps demand a premium in day rates in normal market conditions (roughly balanced demand/supply) is high spec capability.

With the overhang in supply in the current market conditions, it might be an exaggeration to say that the older and lower spec rigs in the industry will be completely marginalized, but it is likely that these units will face more day rate pressure than the high spec, newer units. Amidst fierce competition for work, owners of higher spec units have the option to step down and compete for contracts with the lower spec rigs, potentially forcing some lower spec rigs to keep day rates repressed to stay active. A potentially mitigating factor to note here is that newly built rig owners, especially unestablished rig owners building rigs on speculative basis, have higher day rate hurdles due to financing costs in order to earn acceptable margins.Later in the valuation section, I will use the economics described above to roughly measure its impact on Noble’s Jackup fleet.

Before we move on to examining the other segment for Noble, let’s look at the current contract status for its Jackup fleet

As you can see, most of the contracts expiring in 2010 are in the Mexico region. In fact, all the rigs in the Mexico region are currently contracted to Pemex, Mexico’s state owned petroleum company. In a difficult market like today, it is concerning that these rigs could be out of work for some time. Also, to add to these difficulties, Pemex originally submitted a tender with age restrictions that would have ruled out Noble Corp’s Jackup fleet. However, very few bidders showed up, causing Pemex to lift this restriction. Subsequently, Pemex also submitted its proposal to the finance ministry to up its budget by 54%. As per Noble, in its Q2 call, Pemex may be in the market for another 21 rigs in Feb 2011 because of this budget increase. This news improves prospects for Noble’s expiring contracts in this region lifting some of the near-term concerns relating its expiring contracts.

Semisubmersible segment:

Day rates for the semisubmersible segment have gone up, despite the fall of oil price from its peak. Also, its utilization has stayed in the 90% + range. This trend is not specific to Noble Corp, but is evident industry wide indicating tighter supply. However, since the Deepwater Horizon accident, not only is the short-run outlook for deepwater drilling in the Gulf of Mexico is grim, but the long-term global impact is yet to be fully understood. This uncertainty in my opinion is what creates the opportunity to invest in Noble Corp. Let’s examine Noble Corp semisubmersible fleet:

As you can see from above, only one operator (Anadarko) has terminated contract so far based on force majeure. This termination is currently in dispute, and revenue recognition is being deferred in the current financial reports. Also, as part of the Frontier acquisition, Shell agreed to support Noble during the Gulf moratorium. The agreement let Shell suspend the rig contracts of any rig operating or anticipate to operate in the Gulf during the moratorium, if needed. In exchange, Noble will continue to earn a reduced day rate that will cover its operating costs and allow the rig to be quickly returned to duty. The term of the contract will be extended at original contract day rate to reflect any suspension period. This reduces to a large extent the uncertainty of force majeure for its rigs operating in the Gulf.

Now that BP has capped its oil well, the possibility of extending the moratorium beyond Nov 2010 is much smaller. One of the most likely outcomes is stricter regulations. As an example, drilling contractors may be required to upgrade their fleet to meet with new minimum standards for blowout preventers. The older rigs may need to be redesigned to make space for such blowout preventers rendering them to undergo costly upgrades or possibly make them obsolete. Such a requirement would be a boon to contractors that have a younger fleet, thus creating a competitive advantage for them. In the last quarterly call, the CEO of Noble Corp commented that the cost of upgrading its fleet to meet these requirements are very manageable – “on a per rig basis, we are talking millions not tens of millions of dollars”.

The other possible outcome is a permanent shutdown of deepwater drilling in the Gulf. In such a case, Noble and other contractors in the US GOM would be looking for work elsewhere for its semisubmersibles. Such a scenario will cause the economics of day rates for the Semisubmersibles to be very similar to those in the Jackup segment. Note that offshore US GOM accounts for 30% of US produced crude oil (Source: EIA special report US GOM fact sheet). As per 2006 MMS Estimated Oil and Gas Reserves in US GOM report, most of the remaining proven reserves are in water depth >1500' (considered as deepwater). Also, offshore drilling activity provides major employment for the surrounding states. Given all the above factors and that the BP oil well is now capped, this draconian outcome seems unlikely. Although difficult to quantify, it seems less than 10% probability for such an outcome.

Frontier Acquisition:

Noble recently bought Frontier Drilling. It was a cash transaction for $2.16B. Noble financed the transaction with a combination of cash on hand, and new long-term debt. Noble estimates total debt to go up to $3 billion (currently at $751 million) and the debt/capital ratio to go up to 28% (currently at 10%). Management thinks it can pay off debt in 3 years if it wants to, and the increase in leverage is very manageable. Earnings and cash flow are expected to be accretive starting 2011.

As per analyst estimates at Morningstar®, the acquisition was done at Frontier’s fleet replacement cost and 5x EBITDA. Frontier was facing debt covenant violations in light of potential loss of earnings from the US GOM force majeure termination of one of its rigs. Noble took advantage of Frontier's distress, by using its strong balance sheet to make this acquisition.

As part of the transaction, Noble has added three dynamically positioned drillships, two conventionally moored drillships, one deepwater semisubmersible rig, and one dynamically position FPSO vessel. All of these are already under contract. Also, Noble netted $2 billion in backlog (which is great given that it only paid $2.16 billion). Since Frontier’s 95% of this backlog is with Shell, it agreed to various agreements for Noble’s existing fleet. In addition to the agreements related to its contracts in US GOM described in an earlier section, Noble signed a 10 year contract with Shell for the Globetrotter, which is due to be delivered in the second half of 2011. As per the contract, day rate for the first five years will be $410,000. During the later five years, day rates will adjust based on market rates for such rigs every six months. Shell also agreed to similar terms for a second ultra-semisubmersible rig to be delivered in 2013.

The combined impact of the Frontier acquisition and the agreements with Shell increases Noble’s backlog to $12.9 billion from $6.9 billion previously, second only to Transocean's backlog. While much of the backlog is scheduled in the second half of the decade, the increase is substantial. Another point to note is that Shell prefers to form a relationship with an established player like Noble at higher day rates rather than a marginalized player with newer rigs and lower day rates. Also, it shows that Shell was willing to commit to deepwater for another decade even as the oil spill accident was playing out.

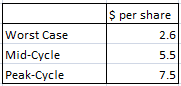

We estimate the earnings power of Noble Corp (excluding accretion to earnings due to the Frontier acquisition) using a worst-case (10% chance), mid-cycle (80%), and peak-cycle (10%) scenario. The details of this estimation are shown in appendix.

Noble traded at a PE ratio of 12-14x in 2006-07. Then, with the onset of the global recession, PE ratio was compressed to 4x. Oil prices recovered but uncertainty remained due to the BP Deepwater Horizon accident, Noble traded at 6x. In the longer-run, Noble ought to trade at 8-12x to reflect the growth characteristics of deepwater drilling. Shown below is a sensitivity matrix for Noble’s stock price.

In the worst case, the downside risk is 36% from the current price (32.6$ on Aug 13, 2010). In the most likely outcome, the upside is 70% (mid-cycle scenario with a PE ratio of 10x). Note that the above is estimated without taking into account the Frontier acquisition.

Appendix: Noble Corp’s Earnings Power Estimate

Assumptions used for the estimate:

Given the above assumptions, we can estimate the average day rates and utilization for the four segments:

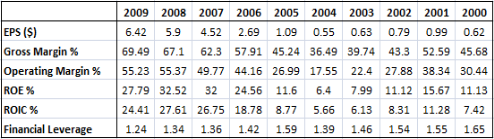

The above give us revenue estimate for each segment under the various scenarios. To estimate earnings power, we need to estimate operating margin for the three scenarios. For peak-cycle, use the highest margin that Noble has achieved in 2007-2009. For mid-cycle, use the average of 2006-2009. For worst-case, use the average of last 10 years. The operating margin in this case is much lower than the mid-cycle scenario, but it models Noble’s costs going up dramatically.

Disclosure: The author has a long position in NE. This is not a recommendation to buy or sell any security. This article is for information purposes only.

No comments:

Post a Comment